Developments In Precious Metals IRAs: A Comprehensive Overview

페이지 정보

작성자 Eugene 작성일 25-08-23 20:54 조회 3 댓글 0본문

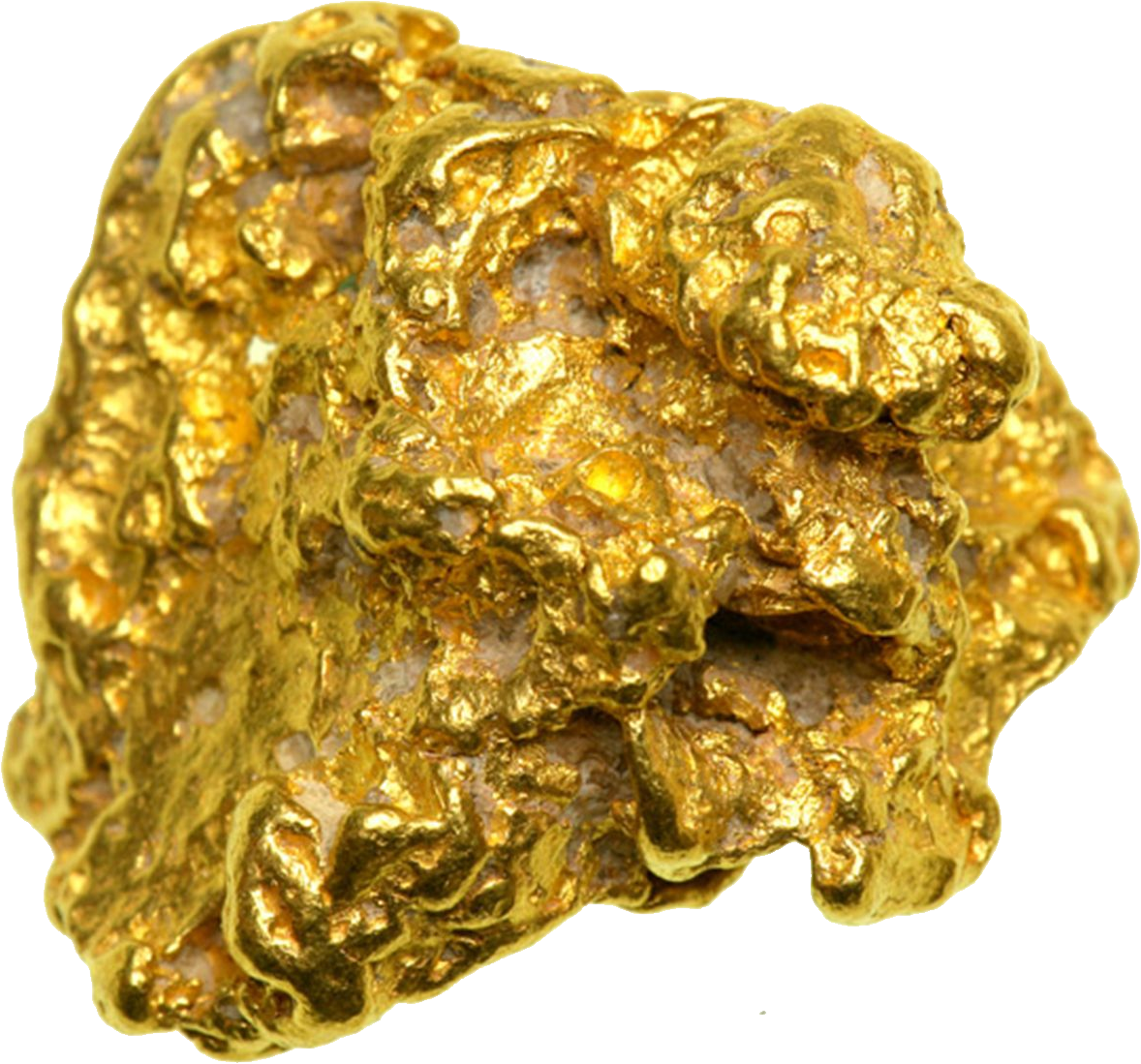

Lately, the panorama of retirement investing has seen important transformations, significantly within the realm of Precious Metals IRAs (Individual Retirement Accounts). These specialized accounts permit buyers to carry bodily precious metals like gold, silver, platinum, and palladium as part of their retirement portfolios. As financial uncertainties and inflation issues rise, extra people are exploring the benefits of diversifying their retirement financial savings with tangible belongings. This article delves into the demonstrable advancements in Valuable Metals IRAs, highlighting key developments, regulatory changes, and progressive investment methods that are shaping the trade.

Understanding Precious Metals IRAs

Precious Metals IRAs are a sort of self-directed IRA that enables buyers to include bodily precious metals of their retirement portfolios. Unlike traditional IRAs that sometimes hold stocks, bonds, and other paper property, Treasured Metals IRAs offer a hedge in opposition to inflation and economic downturns. Buyers can select from a variety of metals, every with its own traits and market dynamics.

Regulatory Developments

One of many most important developments in the Precious Metals IRA house has been the clarification and enhancement of regulatory frameworks. The interior Revenue Service (IRS) has established clear tips relating to the forms of metals that can be included in these accounts. As an example, solely certain coins and bullion that meet particular purity standards are eligible for inclusion. The IRS also mandates that these metals be saved in an authorised depository, making certain their security and compliance.

Latest regulatory updates have streamlined the method for organising and managing Treasured Metals IRAs. If you have any kind of inquiries concerning where and just how to use cost-efficient gold ira investment, you can call us at our own site. New custodians are rising with consumer-pleasant platforms that simplify account administration, making it simpler for investors to navigate the complexities of self-directed accounts. These developments have made Precious Metals IRAs more accessible to a broader viewers, permitting people to take management of their retirement savings.

Revolutionary Funding Strategies

The Precious Metals IRA market has also seen the rise of modern funding methods that cater to a various range of investor preferences. As an example, some custodians now provide distinctive funding options resembling valuable metals ETFs (Trade-Traded Funds) that can be held inside an IRA. These ETFs provide publicity to treasured metals with out the need for bodily storage, appealing to buyers who may be hesitant to manage tangible property.

Moreover, many buyers are actually considering a mixture of physical metals and digital assets. The emergence of blockchain know-how has led to the development of digital gold and silver platforms, where traders should buy and promote fractions of treasured metals in a secure on-line surroundings. This hybrid strategy allows for larger liquidity and flexibility while still benefiting from the stability and historical value of bodily valuable metals.

Enhanced Schooling and Resources

One other notable development within the Precious Metals IRA sector is the elevated availability of academic resources. As extra individuals express curiosity in diversifying their retirement portfolios, reputable custodians and funding corporations are offering complete guides, webinars, and cost-efficient gold ira investment seminars on the advantages and risks associated with investing in treasured metals.

These instructional initiatives are crucial in empowering traders to make knowledgeable choices. They cowl topics reminiscent of market tendencies, historic efficiency, and the function of precious metals in a balanced funding strategy. By equipping buyers with information, the trade is fostering a more knowledgeable clientele that is better prepared to navigate the complexities of retirement investing.

Technological Integration

The combination of technology into the Precious Metals IRA house has revolutionized how buyers handle their accounts. Many custodians now provide strong online platforms that enable traders to trace their holdings, view market prices in actual-time, and execute transactions with ease. This technological development has streamlined the funding course of, making it extra efficient and user-friendly.

Moreover, advancements in cybersecurity measures make sure that buyers' assets and personal information are protected. With the rising prevalence of cyber threats, custodians are investing heavily in secure techniques to safeguard their purchasers' investments. This give attention to security is important in building belief and confidence amongst buyers, encouraging them to explore Treasured Metals IRAs as a viable retirement possibility.

Market Trends and Demand

The demand for Precious Metals IRAs has surged, driven by varied market traits. Financial uncertainty, inflation fears, and geopolitical tensions have prompted investors to seek secure-haven property. Valuable metals have historically been considered as a dependable retailer of value throughout turbulent occasions, leading to elevated curiosity in these assets as part of retirement planning.

Current developments point out a growing preference for silver and platinum, along with gold. As industrial functions for these metals increase, their value proposition is changing into more interesting to investors. This diversification inside the precious metals market affords extra opportunities for growth and risk administration in retirement portfolios.

The Function of Professional Advisors

Because the Precious Metals IRA market evolves, the position of skilled advisors has become more and more necessary. Investors are in search of guidance from financial advisors who concentrate on treasured metals and self-directed IRAs. These professionals present personalized strategies tailored to particular person funding goals, risk tolerance, and market outlook.

Advisors also help traders navigate the complexities of compliance and laws, ensuring that their Valuable Metals IRAs remain in good standing with the IRS. This skilled assist is invaluable for buyers who could also be unfamiliar with the intricacies of precious metals investing, fostering confidence and safety in their retirement planning.

Conclusion

The developments in Treasured Metals IRAs reflect a dynamic and evolving investment panorama. With enhanced regulatory readability, modern funding strategies, and elevated access to instructional assets, investors are higher equipped than ever to incorporate treasured metals into their retirement portfolios. As market traits shift and expertise continues to play a pivotal position, the future of Valuable Metals IRAs looks promising. For these seeking to diversify their retirement financial savings with tangible assets, these advancements present a compelling opportunity to secure monetary stability in an uncertain world.

- 이전글 See What Best Headphones Online Shopping Tricks The Celebs Are Utilizing

- 다음글 See What UK Headphones Tricks The Celebs Are Utilizing

댓글목록 0

등록된 댓글이 없습니다.