One of the Best Places To Buy Physical Gold: A Complete Research

페이지 정보

작성자 Trina 작성일 25-08-13 20:49 조회 44 댓글 0본문

When considering an funding in bodily gold, it is crucial to know where to purchase it. Gold has been a beneficial asset for hundreds of years, serving as a secure haven throughout financial uncertainty and a hedge towards inflation. This report aims to guide potential buyers through the most effective locations to buy physical gold, evaluating varied choices based mostly on factors equivalent to reliability, pricing, comfort, and customer support.

1. Local Coin Outlets

Native coin outlets are sometimes the first stop for those trying to purchase physical gold. These establishments will be found in most cities and towns, providing a convenient option for patrons. One of the advantages of native coin retailers is the opportunity for face-to-face transactions, permitting patrons to inspect the gold earlier than buying. Many coin retailers additionally supply a spread of products, together with coins, bars, and jewelry.

Professionals:

- Speedy possession of gold

- Personal interaction and skilled advice

- Ability to negotiate costs

- Limited selection compared to bigger sellers

- Larger premiums attributable to overhead costs

- Potential for less aggressive pricing

2. Online Dealers

With the rise of e-commerce, many traders are turning to on-line gold dealers. Web sites akin to APMEX, JM Bullion, and BullionVault supply a large selection of gold products, usually at competitive costs. On-line sellers sometimes provide detailed product descriptions, market analysis, and customer opinions, making it simpler for buyers to make informed choices.

Execs:

- Extensive collection of gold merchandise

- Aggressive pricing and lower premiums

- Comfort of shopping from dwelling

- Transport and dealing with fees could apply

- Threat of fraud or scams if not purchasing from reputable dealers

- Delayed possession of gold till supply

3. Treasured Metals Exchanges

Precious metals exchanges, reminiscent of the new York Mercantile Exchange (NYMEX) and the London Metallic Exchange (LME), are platforms the place gold is purchased and bought in bulk. These exchanges cater primarily to institutional buyers and traders, but in addition they supply alternatives for particular person investors to purchase bodily gold by authorized sellers.

Pros:

- Entry to actual-time market costs

- Capability to buy in larger portions

- Transparency in transactions

- More suitable for skilled investors

- Usually requires a significant investment

- Complex trading mechanisms

4. Banks and Monetary Establishments

Many banks supply the choice to purchase physical gold, either within the type of coins or bars. This selection can present a way of safety, as banks are regulated institutions. Some banks even provide gold financial savings accounts, permitting customers to buy gold and store it securely.

Execs:

- Trusted and regulated institutions

- Security of storage options

- Potential for investment diversification

- Higher premiums compared to other sources

- Restricted number of merchandise

- Might require an account with the bank

5. Gold Shows and Expos

Gold reveals and expos are occasions the place dealers, collectors, and traders gather to purchase, promote, and commerce gold and different valuable metals. Attending these events can provide consumers with a possibility to meet multiple sellers in one location, evaluate prices, and acquire insights into the gold market.

Professionals:

- Opportunity to community with trade specialists

- Means to compare costs and merchandise in person

- Entry to uncommon and distinctive objects

- Restricted time frame for purchasing

- Potential for prime-pressure sales techniques

- Journey and accommodation costs if the event is just not native

6. Auctions

Buying gold by auctions will be an exciting possibility for buyers searching for distinctive objects or collectibles. Auctions, whether performed in-particular person or on-line, can present alternatives to accumulate gold coins, jewellery, and historic pieces at aggressive costs.

Pros:

- Potential for lower costs by way of bidding

- Access to unique and rare items

- Exciting shopping for expertise

- Risk of overbidding and paying more than market value

- Restricted inspection time earlier than bidding

- Further charges or commissions could apply

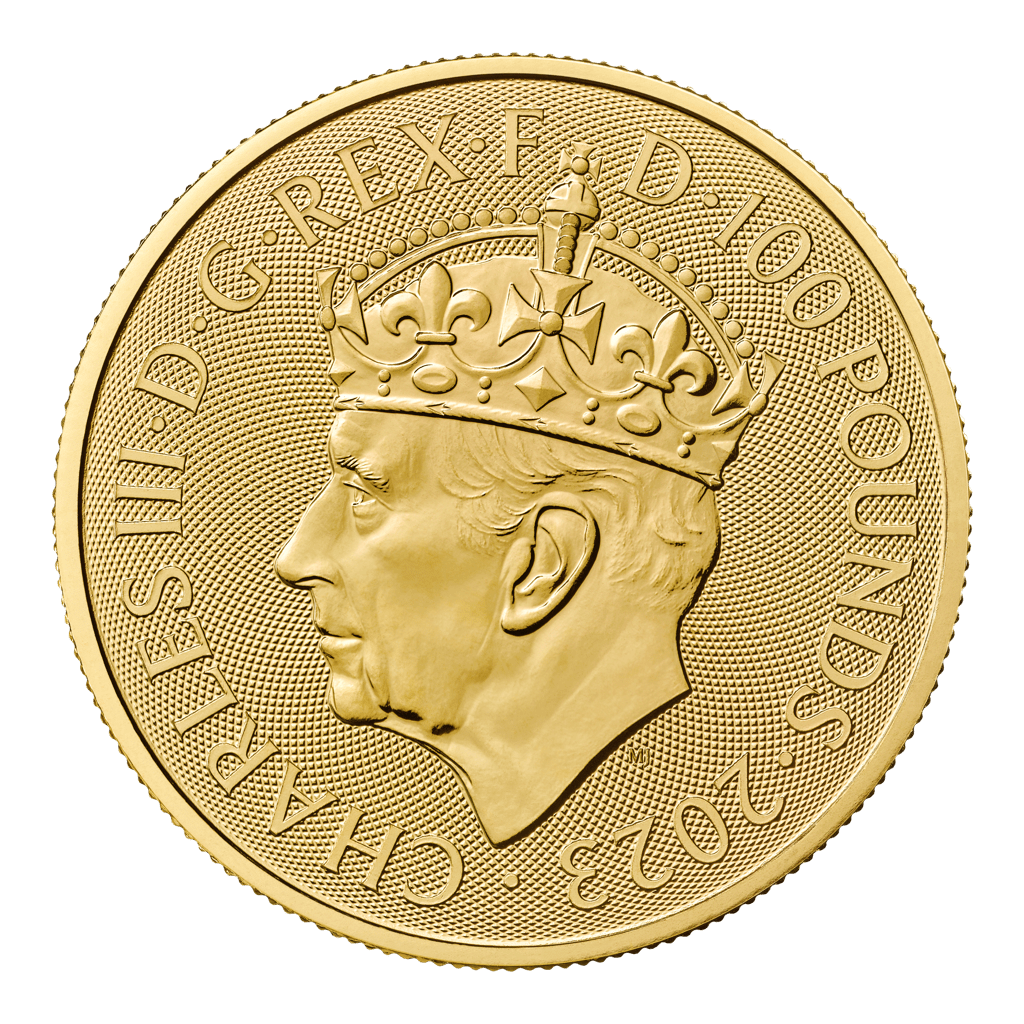

7. Minted Gold Merchandise

National mints, such as the United States Mint, Royal Canadian Mint, and Perth Mint, best place to buy physical gold sell gold coins on to shoppers. These coins typically carry a better premium as a consequence of their authorities backing and acknowledged high quality.

Pros:

- Assurance of high quality and authenticity

- Government backing adds value

- Collectible potential for certain coins

- Increased premiums than other types of gold

- Restricted availability of certain coins

- May require pre-ordering or waiting durations

Conclusion

When choosing the best place to buy physical gold, investors should weigh the pros and cons of each choice primarily based on their individual needs and preferences. Native coin retailers provide immediate access and personal service, while online dealers offer comfort and a broader choice. Treasured metals exchanges cater to skilled traders, while banks present a way of safety. Gold reveals and auctions present unique alternatives for collectors, and national mints offer high quality assurance.

In the end, the best place to buy physical gold will depend upon factors reminiscent of finances, funding goals, and consolation level with the purchasing course of. Regardless of the chosen method, it is crucial for buyers to conduct thorough analysis, confirm the fame of the vendor, and stay knowledgeable about present market traits to take advantage of informed choice potential. Investing in physical gold could be a rewarding enterprise, providing each financial safety and a tangible asset that has stood the check of time.

- 이전글 Emergency Personal Loans For Bad Credit: A Comprehensive Research

- 다음글 Understanding the Best Gold IRA Options Obtainable In 2023

댓글목록 0

등록된 댓글이 없습니다.