The Rising Recognition Of Gold IRAs: A Complete Case Study

페이지 정보

작성자 Carin 작성일 25-08-10 18:56 조회 23 댓글 0본문

Lately, the financial panorama has seen a growing interest in various funding autos, significantly as financial uncertainties and market volatility have prompted traders to hunt safer choices for their retirement savings. One of the notable developments on this arena is the growing reputation of Gold Individual Retirement Accounts (Gold IRAs). This case examine explores the basics of Gold IRAs, their advantages and gold ira companies top rated disadvantages, and real-world examples of individuals who have navigated this funding avenue.

Understanding Gold IRAs

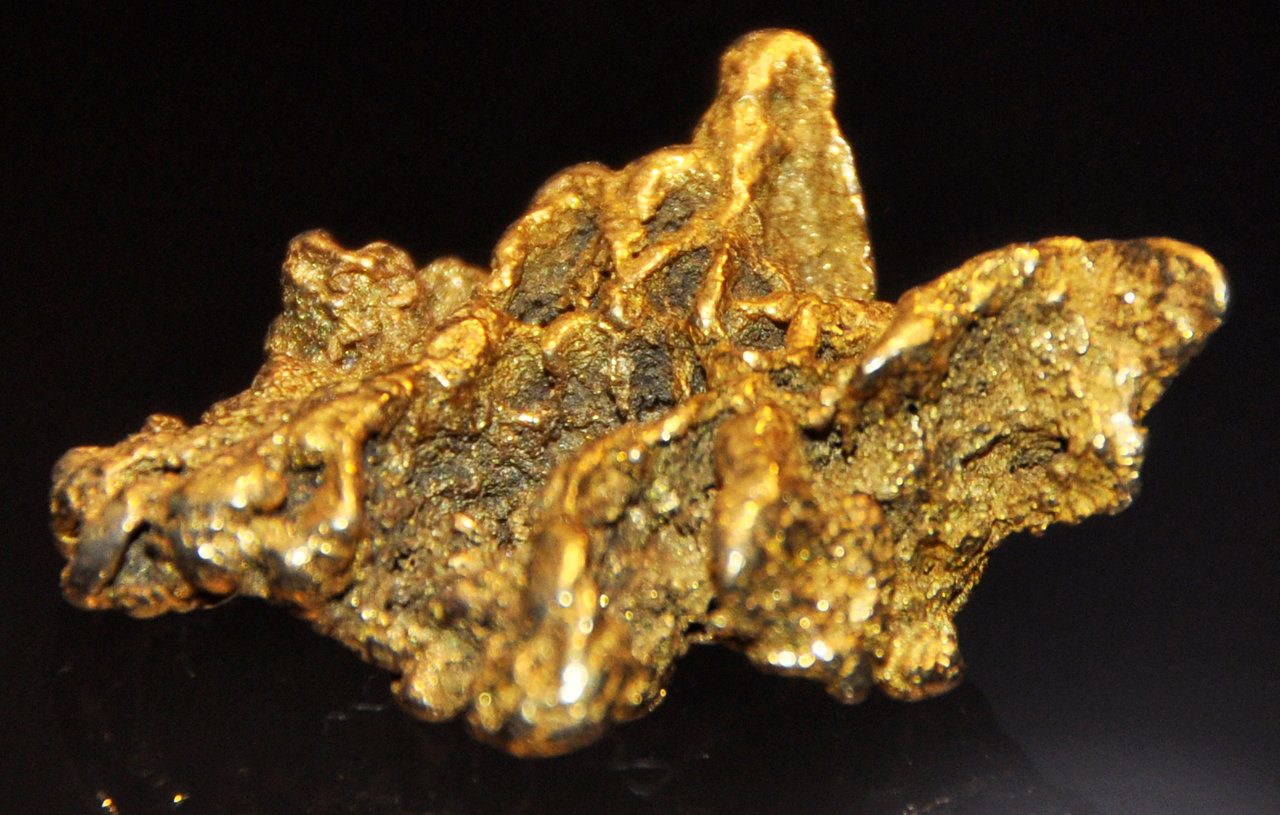

A Gold IRA is a sort of self-directed Particular person Retirement Account that permits investors to hold bodily gold and other treasured metals as a part of their retirement portfolio. In contrast to traditional IRAs that sometimes consist of stocks, bonds, and mutual funds, Gold IRAs provide a singular alternative to invest in tangible belongings which have traditionally been seen as a hedge against inflation and financial downturns.

Gold IRAs should adhere to specific IRS rules, which dictate the forms of metals that may be included. Eligible belongings usually embrace gold bullion, gold coins, silver, platinum, and palladium, offered they meet minimum purity standards. Moreover, Gold IRAs require the involvement of a custodian to handle the account and guarantee compliance with IRS guidelines.

The benefits of Gold IRAs

- Inflation Hedge: Gold has long been thought of a protected haven asset throughout intervals of high inflation. As the worth of paper currency declines, gold usually retains its buying power, making it an attractive choice for preserving wealth.

- Diversification: Including gold in a retirement portfolio can improve diversification. Gold often has a low correlation with traditional asset courses, that means that when stocks and bonds are underperforming, gold ira companies top Rated may perform effectively, thereby lowering general portfolio danger.

- Tangible Asset: gold ira companies top rated In contrast to stocks and bonds, gold is a bodily asset that investors can hold. This tangibility can provide peace of thoughts, notably throughout occasions of financial uncertainty.

- Tax Benefits: Gold IRAs offer the identical tax benefits as traditional IRAs. Contributions could also be tax-deductible, and funds can grow tax-deferred till withdrawal, at which point they are taxed as peculiar income.

The Disadvantages of Gold IRAs

- Storage and gold ira companies top rated Insurance Costs: Holding physical gold requires secure storage, which might lead to extra prices. Buyers should also consider insurance to guard their property, additional growing the general expense of sustaining a Gold IRA.

- Limited Progress Potential: Whereas gold can be a stable store of worth, it does not generate earnings like stocks or bonds. Investors may miss out on potential progress alternatives that come from dividends or interest funds.

- Market Volatility: Although gold is often considered as a protected haven, its value may be volatile, influenced by components similar to geopolitical occasions, foreign money fluctuations, and adjustments in curiosity charges.

- Complexity of Setup: Establishing a Gold IRA involves extra steps than organising a conventional IRA. Traders should choose a good custodian, choose the proper forms of gold, and ensure compliance with IRS rules.

Real-World Examples

For example the influence of Gold IRAs, we will take a look at two hypothetical buyers: John and Mary.

John's Experience: John, a 55-year-outdated engineer, was concerned about the potential for economic downturns affecting his retirement financial savings. After conducting thorough research, he decided to allocate 20% of his retirement portfolio into a Gold IRA. He selected to put money into gold bullion and coins that met IRS standards. Over the years, John found that throughout intervals of inventory market decline, his gold holdings offered stability, allowing him to weather market fluctuations with out vital losses. As he approached retirement, John felt more secure understanding that he had a portion of his savings in a tangible asset.

Mary's Expertise: In contrast, Mary, a 45-yr-old entrepreneur, was initially skeptical about investing in gold. She most popular to focus on stocks and bonds, believing they supplied higher progress potential. Nonetheless, after experiencing a big market downturn, Mary reconsidered her technique. She determined to diversify her portfolio by opening a Gold IRA. Whereas she faced challenges find a reputable custodian and gold ira companies top rated understanding the storage requirements, Mary ultimately felt relieved to have added gold to her retirement strategy. Because the economy began to get well, she appreciated the stability that gold brought to her general investment combine.

Conclusion

The growing popularity of Gold IRAs displays a broader pattern among traders seeking to safeguard their retirement financial savings against financial uncertainties. While Gold IRAs offer unique benefits, resembling inflation protection and diversification, in addition they come with their own set of challenges, including storage prices and market volatility.

As illustrated by the experiences of John and Mary, Gold IRAs can function a precious element of a well-rounded retirement technique. However, potential investors should conduct thorough research and consider their particular person monetary goals and threat tolerance before committing to this investment car. Because the monetary landscape continues to evolve, Gold IRAs stay a compelling possibility for those trying to boost their retirement portfolios with tangible assets.

- 이전글 Easy Approval Personal Loans For Bad Credit: A Comprehensive Evaluation

- 다음글 Scheduling A Driving Test Tips That Can Change Your Life

댓글목록 0

등록된 댓글이 없습니다.